CONFERENCE-DEBATE INSTITUTE AFRICA WORLD PARIS

THE FINANCIAL MARKET IN THE CEMAC AREA: WHAT FUTURE?

By

Mathurin DOUMBE EPEE

Chairman of the Board of Directors

Société Générale Cameroon

Paris March 19, 2018

Preamble

The Financial Market is a meeting point and a geographical or virtual confrontation between the demand for and supply of long-term capital for private or public securities (financial assets and their derivatives), within the framework of regulated and organised or over-the-counter investment services, which are generally referred to as a Stock Exchange. It is from this Financial Market that States call upon for the financing of their medium- and long-term investment needs in the event of shortfalls in budgetary revenues, which is generally the case.

The same applies to private and public companies that use this alternative financing method for heavy investments for which banks cannot provide financial coverage due to a lack of long-term resources.

The financial market therefore appears to be an innovative financing method that can “boost” growth, create jobs and, better still, fight poverty.

What is the future of the financial market in the CEMAC zone ?

This is the theme I will develop before you tonight.

A – Basis Data on CEMAC

1 – Some Statistics on CEMAC

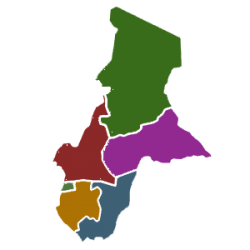

Member Countries

- Cameroon

- Equatorial Guinea

- Congo

- Central African Republic

- Gabon

- Chad

Area: 3,020,144 km2

Population

49.3 million inhabitants (including 24 ms for Cameroon)

GDP

| Year | 2015 | 2016 | 2017 |

|---|---|---|---|

| CEMAC Area GPD (%) | 1.6 | 0.2 | 0.5 |

| Cameroon GPD (%) | 5.8 | 4.5 | 3.7 |

Significant Natural Resources

- Agriculture: coffee, cocoa, wood, bananas, cotton, tea, millet, sorghum…

- Mining: gold, bauxite, manganese, diamond, nickel

- Petroleum

- High hydroelectric potential not yet fully exploited.

- Natural resources more important than those of WAEMU.

Yet UEMOA:

- Area: 3,506,126 km2

- Population: 114 million inhabitants

2 – Turbulence in the CEMAC Area

Economic growth in disarray

| Year | 2015 | 2016 | 2017 |

|---|---|---|---|

| Growth (%) | 1.6 | 0.2 | 0.5 |

- Oil, the catalyst of this crisis.

Indeed:

A sharp drop in the price of a barrel of oil

- From 120 dollars, the barrel sometimes dropped to 50 US dollars.

- The current recovery, at US$65, remains far from the previous highs.

A serious dependence on oil

On average, oil accounts for more than 75% of the export earnings of CEMAC member countries, with the exception of Cameroon:

| In %/ EXPORT REVENUES | |

|---|---|

| Equatorial Guinea | 90% |

| Congo | 90% |

| Gabon | 85% |

| Chad | 80% |

| Cameroon | 40% |

Consequences :

- Drastic cuts in government budget revenues;

- Discontinued worksites and investment programs;

- Salaries of civil servants who are poorly paid or even declining;

- Repayments of deferred internal and external debts;

- Increasing budget deficits;

- Increase in the debt ratio (50%/GDP in 2017, or even more for some countries…….

- Growth decline.

How did it come to this?

Very low diversification of CEMAC’s economies

With the exception of Cameroon, the CEMAC countries have predominantly oil-based economies. The drastic drop in the price of oil has therefore hit them hard and weighed heavily on their foreign exchange reserves.

Consequence :

Convening of an Extraordinary Summit of Heads of State of CEMAC on 23 December 2016 in Yaoundé

They also took part:

- Mrs Christine LAGARDE, Managing Director of the IMF

- Mr. Michel SAPIN, Minister of Finance of France.

The observation was severe:

The foreign exchange reserves of the CEMAC Zone no longer covered the three statutory months of imports.

The Central African CFA Franc came close to devaluation. If it had been, it would have been the only one, with the Uemoa Zone maintaining its parity against the Euro, with a growth rate of over 6%.

Very opportunely, it was therefore narrowly saved, following the commitments of the Heads of State of CEMAC to do everything possible to recover the economies of the Sub-Region.

In fact, in exchange for the non-devaluation, the CEMAC countries had to agree to return to the IMF’s tailpipes, i.e. under this well-known regime called “structural adjustment”, with the exception that it is each country that negotiates its programme with the Fund, and no longer the whole Area.

Current situation

Slight improvement in exchange rates. However, significant efforts will have to be made to get CEMAC out of this turbulent area.

Political and security uncertainties

- Post-election situation not yet under control in Gabon

- Attempt to destabilize Equatorial Guinea

- Tense social climate in Chad (drastic drop in wages)

- Continued attacks by the Islamic sect Boko Haram in northern Cameroon and Chad

- Secessionist tendencies in Cameroon’s Anglophone Zone, which, combined with the previous point, leads to very heavy expenses that create deep furrows in Cameroon’s budget.

Presidential elections in Cameroon in October 2018:

- a certain wait-and-see attitude on the part of the business community and Observers

- an inevitable slowdown in government action.

This is the situation in the CEMAC Zone.

Under these conditions, would the Financial Market have been the other mode of financing that could have mitigated this depressurization of the CEMAC Zone and what is its future ?

B – The Coexistance of the Two Scholarships: A Serious Handicap

Two Stock Exchanges on the CEMAC Financial Market:

Cameroon: Douala Stock Exchange “DSX”.

Gabon: Bourse des Valeurs Mobilières de l’Afrique Centrale ” BVMAC “.

1- Genesis of Cohabitation

A Common House

The steps of its constitution

Libreville 1994

Aware of the delay in the creation of the Financial Market in comparison to the Uemoa zone, the Heads of State of CEMAC decided, in 1994 in Libreville, to create a Stock Exchange in Central Africa and entrusted its study to the Mauritius Stock Exchange.

January 1999

After five years of study, the Mauritius Stock Exchange held a seminar in Douala in January 1999 to present the feasibility study on a Financial Market in Central Africa. It was attended by the elite of national, regional and international finance.

The conclusions of this seminar were:

- invite the Bank of Central African States (BEAC) and the Donors to do their utmost to accelerate the process leading to the elaboration of the regulatory and regional control framework with immediate implementation and the creation of the Central African Financial Market by December 2000 at the latest.

- to specify that “however, it is understood that, in order to support the privatisation programmes undertaken, to meet the need to exchange the securities issued and to support financial savings, countries that so wish could set up transitional securities exchange structures that will later become part of the Regional Market”.

Should it be pointed out that during this seminar, the question that everyone was asking themselves was to know where the future headquarters of the Stock Exchange would be located: Douala or Libreville? Or the eternal competition!

December 2000

Meeting of CEMAC Heads of State in Ndjamena in December 2000. Although the item of the headquarters of the Regional Financial Market was not on the agenda, President Bongo asked his Peers, present in the Chadian capital, to add it.

The Cameroonian Head of State was absent and was represented at the Summit by the then Prime Minister, Peter Mafany Musunge. As he was not Head of State, he did not take part in the vote on the designation of the country and city to house the headquarters of the Regional Financial Market. Should it be stressed and recalled that this item was not on the agenda of this Summit? That’s how Libreville was chosen.

December 2000

Furious at this decision, which took no account of Cameroon’s weight in the Sub-Region, either demographically or economically, President BIYA decided to launch the construction of the Cameroon Stock Exchange, with the immediate establishment of a start-up unit.

This is therefore the breaking point at the origin of the creation of the two exchanges in the CEMAC zone: the choice of Libreville as the headquarters of the Regional Exchange.

But Separate Rooms

- The steps in the constitution of “DSX”

November 2001

Official creation of Douala Stock Exchange and appointment of its General Manager, with the following main missions:

- design and implement DSX

- effectively start its activities BEFORE those of Libreville!

December 2001-December 2004

- Implementation of the operational structures of the Douala Stock Exchange: organization and functioning of the Exchange, listing site, Public Prosecutor’s Office regulations, conditions of access to the Market (Large Companies and SMEs), pricing conditions of the Exchange

- Setting up of the operational structures of the Central Custodian, the Caisse Autonome d’Amortissement “CAA”, with EUROCLEAR as its technical partner. Simulation of quotations: from fixing to settlement and delivery

- Public and economic operators’ awareness and information campaign on the stock market and financial industry: conferences, seminars, symposia, round tables.

January 2005

- Referral to the Trusteeship for an attractive stock market tax system;

- Proposal to the Trustees of a list of attractive companies to be listed on the stock exchange.

January 2006

- Adoption of Stock Exchange Taxation

- Communication by the Minfi of a “very light” list of companies eligible for the stock exchange.

Friday June 30, 2006

First listing on the Douala Stock Exchange Market: that of the Cameroon Mineral Water Company “SEMC”.

- EIGHTEEN MONTHS OF DIFFERENCE BETWEEN THE END OF THE PLACE OF DSX AND THE FIRST RATING.

- The steps in setting up the BVMAC

December 2001

Creation of the “Cosumaf” Financial Market Supervisory Commission

January 2003

Choice of Libreville as the headquarters of Cosumaf.

November 2003

CEMAC-Umac Regulation on the organisation, functioning and supervision of the Central African Financial Market.

December 2004

Appointment of the General Manager of BVMAC, three years after DSX’s appointment

August 2008

First quotation

2 – A Serious Handicap

Destabilization of Potential Investors

- Lack of readability

- Lack of benchmarks

- Be cautious for fear of possible “reprisals” from one or the other country.

Dissuasive Constraints

- Sub-regional savings breakdown

- Dispersion of potential issuers

- Preparation of a file per stock exchange

- Laborious monitoring of the duties arising from the admission of securities to trading

Narrowness and lack of depth of both Markets - Dispersion of resources

The Two Steps without Relief and a Nod to the BRVM

| DSX | BVMAC | BRVM | |

|---|---|---|---|

| Equity Sub-Fund (Number of Stocks) | 3 | 1 | 45 |

| Bond Sub-Fund (Number of Stocks) | 5 | 7 | 42 |

- The gap widens

| BRVM | DSX | BVMAC | |

|---|---|---|---|

| First Quote | Sept 1998 | ||

| First Quote | June 2006 | ||

| First Quote | August 2008 |

- 8 years gap between the BRVM and DSX

- 10 years of distance between the BRVM and the BVMAC.

C – October 31, 2017: A Healthy Start,

PROVIDED THAT……….

1) The N’Djamena Summit of October 31

2017

Extraordinary meeting of CEMAC Heads of State in N’Djamena: important decisions.

FINALLY POSITIVE MEASURES

- Confirmation of COSUMAF as a Regulator

Cosumaf thus retains its role as regulator of the Regional Financial Market, with headquarters in Libreville. Although Cameroon had created its own stock exchange with its own regulator, the Financial Markets Commission (CMF), it had continued to pay its contributions to Cosumaf and had even appointed representatives, which will obviously facilitate its operationality as a regulator of the Douala Regional Stock Exchange.

- Establishment in Douala of the headquarters of the new Regional Stock Exchange

- Designation of the Bank of Central African States “BEAC” as:

- Central Custodian

- Settlement Bank

The Scope of these Measures and their Implementation Deadlines

- The scope of the measures

- Scheduled disappearance of DSX and BVMAC

- Creation of the Douala Regional Stock Exchange and its implications:

- A headquarters to be built in Douala;

- A new social capital to be set up;

- A new Board of Directors to be appointed;

- A staff to be recruited;

- Design and implementation of a new quotation server;

- A transfer to the new Douala Stock Exchange of DSX and BVMAC shares;

- A possible renewal of the approved Intermediaries of the two former stock exchanges, the Investment Service Providers (ISPs), the Brokerage Companies (SDBs) and their Traders.

- BEAC

- Takeover by BEAC of the Central Custodian activities carried out by the Caisse Autonome d’Amortissement du Cameroun and by the BVMAC “ad hoc” Department

- Opening at BEAC, Settlement Bank, of the accounts of approved Intermediaries (ex- ISP and SDB).

Application deadlines

Implementation of the Douala Regional Stock Exchange in June 2019:

Somewhat unrealistic time frame given the complexity of the operations.

Transitional measures

- An additional act should specify them: it is still awaited.

Consequently, October 31, 2017 is an important and decisive step for the future of the CEMAC Zone Financial Market. This Market should thus receive a new impetus likely to enable the Sub-Region to return to growth, provided that….

2) The Prerequisites for an Effective Start

of The CEMAC Financial Market

Real natural assets, but a necessary diversification of economies to reduce dependence on oil: commitments have been made.

a) Political measures

- Full opening of borders

Currently effective since the Summit of Heads of State on 31 October 2017 in Ndjamena.

Very significant progress (in force in Uemoa since 1994!) to “boost” growth and regional integration.

- The political will of States

- This political will, which seems to be manifesting itself at the moment, needs to be reinforced by rigorous monitoring of the implementation of the new stock exchange.

- Cameroon, a Leadership to be reaffirmed

- With 42% of CEMAC’s GDP and nearly 50% of its population, Cameroon should regain its role as a Leader country, like Côte d’Ivoire in the Uemoa zone.

- It will be the awakening of Leo: a “sine qua non” condition

- Good Governance and the Rule of Law

- These are prerequisites for any investor.

In these areas,

- Progress has been made, including in the fight against corruption.

- However, this progress still needs to be consolidated.

- Consolidation of State Public Finances

An unavoidable step for any possible recourse by States to the Regional Financial Market. This consolidation will necessarily require, in the event of excessive debt, a “Securitisation” of domestic and foreign debts. This was the case in Cameroon in the 2000s. These securities could be traded in the “Over-the-counter” compartment of the future Douala Regional Stock Exchange.

The advantages:

- Preservation of low monthly resources

- Obligation to assign them to projects of general interest

- Opening to the IMF for concessional loans.

- Use of the stock exchange for privatisations

Example of the Abidjan Stock Exchange “BVA”.

The 32 shares included in the “BVA” came from President Houphouët – Boigny’s “invitation” to companies operating in Côte d’Ivoire to sell 20% of their share capital to Ivorians.

It is therefore these 32 companies that have been transferred to the BRVM and which currently form the basis of the 45 stocks listed on this stock exchange.

It is to be hoped that CEMAC, which had hitherto favoured “over-the-counter” trading, will take this path and transfer part of the States’ portfolio to the Nationals, provided, however, that the companies concerned are “in bonis” and not in deficit.

- It is on this (solid) basis, resulting from political will, that the effective start-up of the Douala Regional Stock Exchange should be supported.

- THE ROLE OF THE STATES IS THEREFORE CRUCIAL: THEY ARE THE ONES WHO WILL LEAD PRIVATE COMPANIES INTO THE CEMAC FINANCIAL MARKET AND DRIVE IT FORWARD.

b) Technical measures

- Rapid implementation of the Douala Regional Stock Exchange

- Communication of a roadmap on milestones and deadlines

- Urgent transitional measures: Additional Act to be promulgated.

- Wise choice of staff

This is one of the key points for the future of the Regional Financial Market:

- Dosages by country and by “village proximity” are inevitable, but the choices will have to be made by professionals: there are them in all regions and in all countries.

- Partnership with a mature African Stock Exchange is desired. Why not the one in Casablanca or Tunis?

- Revival of growth by:

- A choice of investments with growth potential and multiplier effects

- Attractive tax incentives, such as the Casablanca Stock Exchange

- Creating an economic and institutional environment conducive to investment

- Proactive policy to accelerate the diversification of the economies of the Sub-Region

- Rapid repatriation of export revenues

- Implementation of selective exchange controls to preserve the level of foreign exchange reserves.

In total, we can currently see:

- A timid recovery in growth that the Regional Financial Market should further consolidate.

- To know and make known the Financial Market

A training and, above all, an information campaign is essential to attract:

- Investors to invest their money on the stock market

- Issuers to finance their heavy investments, a source of inclusive growth.

For example, BRVM has just launched its investment days, the “BRVM Investment Days”, which will lead it to roadshows on March 14, 2018 in Johannesburg, on May 2, New York and will end on September 20, 2018 in London.

Objective: to attract investors for the emergence of the Uemoa Sub-Region.

The same should be true for the Douala Regional Financial Market:

- HE’LL HAVE TO COMMUNICATE !

In conclusion, since 31 October 2017, the Financial Market has had a future. But, as there is by far from the lip service, there are still steps to be taken to make it operational. However, only political will can accelerate the pace of its implementation, reassure economic operators and thus enable the Regional Financial Market to play its role as an alternative and innovative financing method for better inclusive growth in the CEMAC Zone.